The discussions aimed to analyse how digitization contributes to the development of financial systems, understand how financial digitization can foster sustainable development and highlight the associated risks and the necessary regulations of financial digitization.

The conference brought together approximately 70 attendees at the physical venue and another 100 participants online. It was opened by Villeroy de Galhau, Governor of the Banque de France, followed by Morten Bech, Director of the Innovation Hub at the Bank for International Settlements.

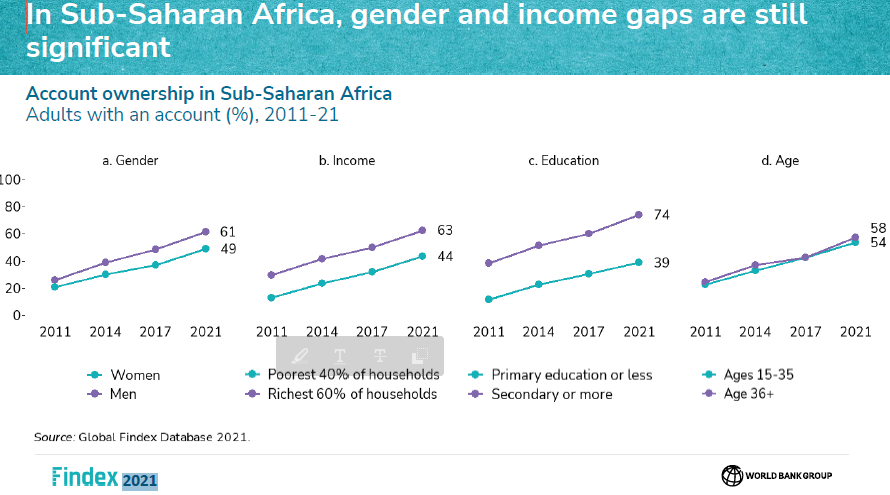

Initially rooted in payment methods, particularly mobile money, mobile banking has now diversified swiftly into savings products and credit provision. This transformation has played a pivotal role in expanding access to financial services across Africa. As per the World Bank, the rate of financial inclusion surpassed 55% in 2021, a stark contrast to the 23% recorded a decade earlier. Nevertheless, notable disparities in financial access persist, particularly concerning income levels and gender.

This form of financial advancement holds the potential to drive economic growth by yielding productivity gains across both the private and public sectors. These gains manifest in various ways, including streamlined commercial transactions, efficient salary and allowance disbursements, and improved tax collection, as well as enhanced cross-border transactions.

Furthermore, as a factor of social cohesion, by enabling the gradual financial inclusion of vulnerable populations and minority groups, it is also a vector for reducing the informal sector, which is particularly high in Africa.

This means adopting harmonised rules to ensure customer identification, transparency of transactions and digital financial products, notably by providing sufficient information to customers, and securing the financial infrastructure underpinning the sector. Financial digitisation also calls for particular vigilance to counter the risks of fraud or those linked to the fight against money laundering and the financing of terrorism (AML/CFT).

Finally, the development of digital financial services in Africa means meeting the dual challenge of financial and digital education for the public.

The high-level panel included Aivo Handriatiana Andrianarivelo, Governor of the Central Bank of Madagascar, Jean-Claude Brou, Governor of the Central Bank of West African States and Harvesh Seegolam, Governor of the Central Bank of Mauritius.

Discussions centred on the expected benefits of CBDCs, such as augmenting the spectrum of payment options and offering a secure, dependable digital currency that upholds monetary sovereignty. Additionally, there was deliberation on the costs and risks associated with the development of digital currencies.

François Villeroy de Galhau, Governor, Banque de France

Morten Bech, Director of Swiss Innovation Hub, Bank for International Settlements

Moderator :

Thomas Mélonio, Executive Director of Innovation, Strategy, and Research at Agence Française de Développement

Introducing presentation :

Leora Klapper, Lead Economist in the Development Research Group, World Bank

Discussion :

Madga Bianco, Head of the new Directorate General for Consumer Protection and Financial Education, Bank of Italy

Philippe Garsuault, Strategic advisor, Skaleet

Gisèle Catherine Keny Ndoye, Director for Financial Inclusion, Banque Centrale des Etats d’Afrique de l’Ouest

Stéphane Tabarié, French Treasury

Moderator :

Patrick Guillaumont, President, Fondation pour les Etudes et Recherches sur le Développement International

Introducing presentation :

Céline Rochon, Senior economist, International Monetary Fund

Discussion :

Younoussa Imani, Governor, Central Bank of Comoros

Purva Khera, Economist, International Monetary Fund

Frannie Leautier, Chief Executive Director, SouthBridge

Sheila Okiro, Chief Investment Officer, African Development Bank

Vera Songwe, Chair of the Liquidity and Sustainability Facility, Co-Chair of the High-Level Expert Group on Climate Finance and Non-Resident Fellow, The Brookings Institution

Moderator :

Bruno Cabrillac, Deputy Director General of Economics and International Relations, Banque de France

Introducing presentation :

Robert Wardrop, Professor, Director and co-founder of the Cambridge Centre for Alternative Finance

Discussion :

Eric Duflos, Financial systems senior specialist, CGAP

Timothée Dufour, Expert Fintech Pole, ACPR

Miles Larbey, OECD

Blaine Stephens, Advisor, Inclusive Finance, CERISE

Ernest Karré, Bank of Central African States

Moderator:

Erick Lacourrège, Director General Cash Retail Payment, Banque de France

Panel :

Aivo Handriatiana Andrianarivelo, Governor, Central Bank of Madagascar

Morten Bech, Director of Swiss Innovation Hub, Bank for International Settlements

Jean-Claude Brou, Governor, Banque Centrale des Etats d’Afrique de l’Ouest

Harvesh Seegolam, Governor, Bank of Mauritius

Christian Yoka, Director of Africa department, AFD

Patrick Guillaumont, President, FERDI